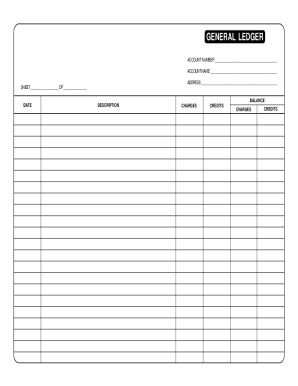

Self-Employment Income Ledger 2010-2026 free printable template

Show details

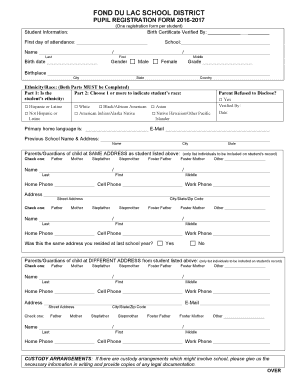

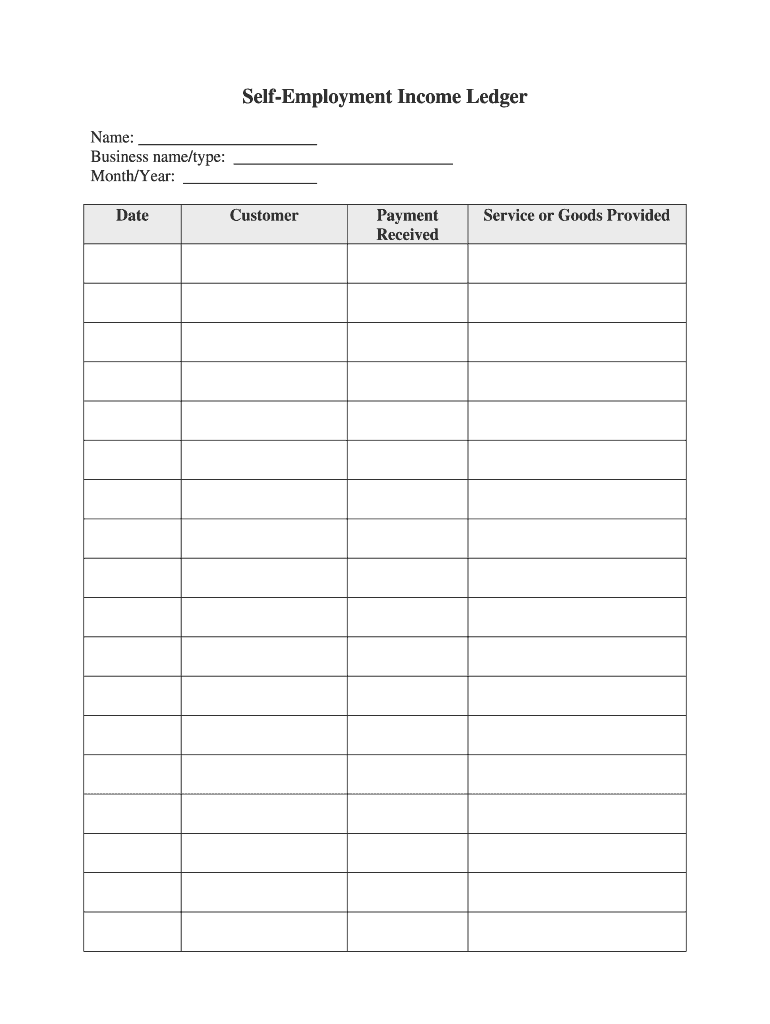

Self-Employment Income Ledger Name Business name/type Month/Year Date Customer Payment Received Service or Goods Provided.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign income ledger form

Edit your self employment ledger template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self employment template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing self employment income ledger online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit income ledger template form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out self employment ledger pdf form

How to fill out Self-Employment Income Ledger

01

Start by obtaining a copy of the Self-Employment Income Ledger form.

02

At the top of the ledger, fill in your name and contact information.

03

Create a section for each income source, such as freelance work or small business sales.

04

For each income source, record the date of the income received.

05

Write down the amount earned for each entry.

06

Include a brief description of the service or product provided.

07

Keep track of any related expenses by recording them in a separate section or column.

08

Total the income and expenses for a specific period (monthly, quarterly, or annually).

09

Ensure to keep all supporting documents such as invoices or receipts for accuracy.

10

Review and update the ledger regularly to keep accurate records.

Who needs Self-Employment Income Ledger?

01

Self-employed individuals.

02

Freelancers and independent contractors.

03

Owners of small businesses.

04

Anyone who earns income outside of traditional employment.

05

Individuals managing multiple income streams.

Fill

monthly self employment ledger template

: Try Risk Free

People Also Ask about self employed ledger

What is self-employed employment verification?

Not only does the 1099-NEC serve as a record of an independent contractor's salary verification, but it also gives them a form to attach their Form 1040 to. Form 1099-NECs is also used for employment verification. Since it provides physical proof of self-employed income, the amount earned and, where it came from.

What is a self-employment ledger?

Any accurate, detailed record of your self-employment income and expenses. It can be a spreadsheet, a document from an accounting software program, a handwritten "ledger" book, or anything that records all self-employment income and expenses.

How is self-employment income verified?

The lender may verify a self-employed borrower's employment and income by obtaining from the borrower copies of their signed federal income tax returns (both individual returns and in some cases, business returns) that were filed with the IRS for the past two years (with all applicable schedules attached).

How does IRS verify self-employment income?

Annual Tax Returns A federal income tax return is conclusive proof of all your earnings within the year. This legal document, which shows your total income for the year and is filed at the IRS, is perhaps the most credible proof of income documentation you can show if you're self-employed.

How do I create a self-employment ledger?

How to use a manual self-employment ledger Open a spreadsheet or download a self-employment ledger template. Create a column for Income (money you've received) and Expenses (cost of running your business) Under Income add three columns: Date, Invoice, and Service/Product.

What is a ledger for proof of income?

A self-employment ledger form is an accurate, detailed record or document of your self-employment income and expenses. A self-employment ledger can be kept online via a spreadsheet, a document from an accounting software program, or even on a handwritten records book or spreadheet.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get self employment log sheet?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the self employment ledger documentation in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I complete self employment ledger example online?

pdfFiller has made filling out and eSigning filling out the self employment and aids in tax compliance easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit self employment ledger form straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing what is a self employment ledger, you can start right away.

What is Self-Employment Income Ledger?

The Self-Employment Income Ledger is a document used by self-employed individuals to record their income and expenses related to their business activities. It helps in tracking financial performance for tax purposes.

Who is required to file Self-Employment Income Ledger?

Individuals who are self-employed, including freelancers, independent contractors, and small business owners, are typically required to file a Self-Employment Income Ledger.

How to fill out Self-Employment Income Ledger?

To fill out the Self-Employment Income Ledger, self-employed individuals need to enter detailed records of their income sources and expenses incurred while conducting business. This may include sales, service fees, cost of goods sold, and business-related expenses.

What is the purpose of Self-Employment Income Ledger?

The purpose of the Self-Employment Income Ledger is to provide a comprehensive record of income and expenses that can be used for tax reporting, budgeting, and analyzing the financial health of the business.

What information must be reported on Self-Employment Income Ledger?

The Self-Employment Income Ledger must report information such as total income earned, types of income, business expenses, net profit or loss, and any other relevant financial details related to self-employment activities.

Fill out your Self-Employment Income Ledger online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How To Fill Out Self Employment Income Ledger 09 is not the form you're looking for?Search for another form here.

Keywords relevant to simple self employment ledger template

Related to self employment income statement template

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.